Ever felt like your crypto portfolio is this wild beast you just can’t quite tame? Yeah, me too. Especially when I first dove into the Solana ecosystem and started juggling SPL tokens alongside yield farming. It’s like trying to keep track of pennies in a hurricane. Short sentences help here: Wow! The sheer speed and volume of transactions on Solana can feel overwhelming at times.

Initially, I thought any wallet would do the trick, but man, I was wrong. There’s a subtle art to portfolio tracking when you’re deep in SPL tokens, and your choice of wallet makes a world of difference. Longer chains of thought hit me — if your wallet can’t integrate seamlessly with staking and DeFi tools, you’re missing out on a lot. It’s not just about storing assets; it’s about managing them smartly.

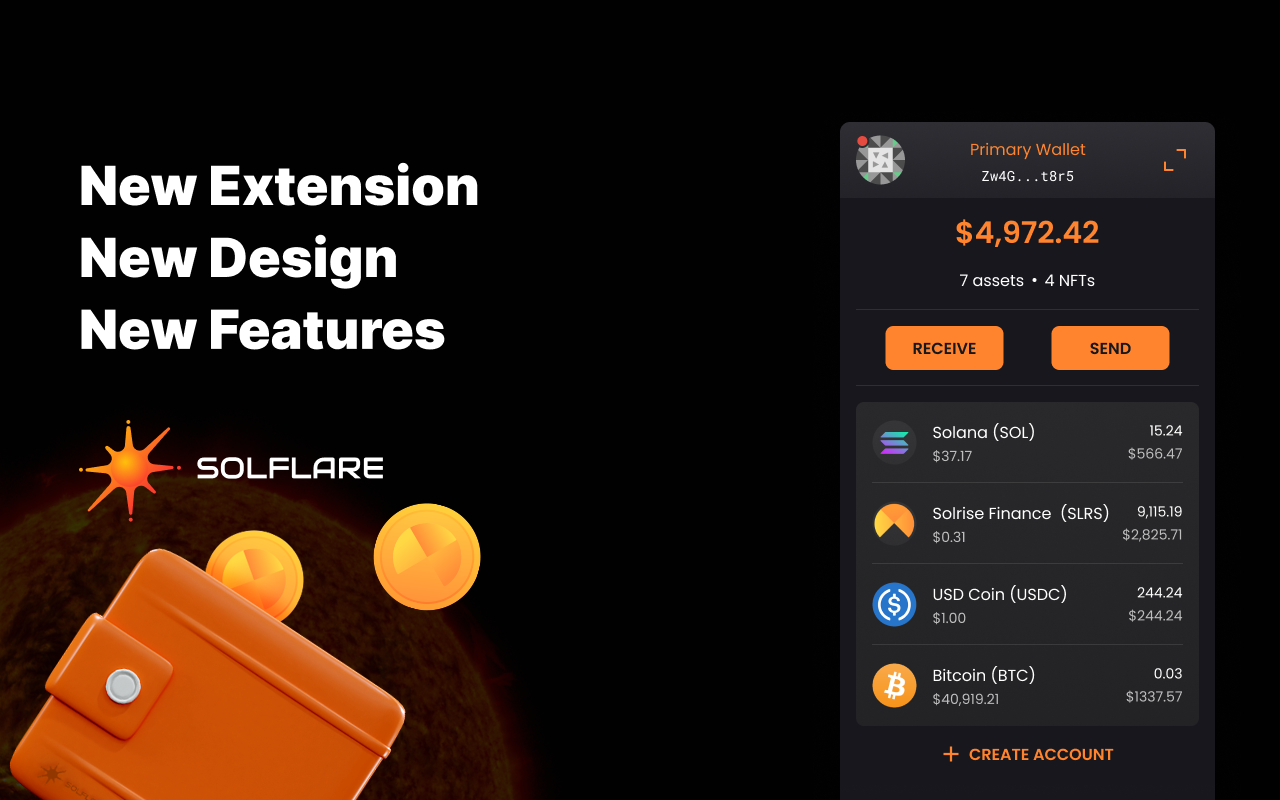

Here’s the thing. You want a wallet that’s not only secure but also user-friendly and tailored for Solana’s unique ecosystem. My gut said, “Go with something proven,” and that’s when I stumbled upon the solflare wallet. Seriously? It felt like the puzzle piece I didn’t know was missing.

But wait — before you rush to download it, let me walk you through why this matters so much, especially if you’re into yield farming and tracking your SPL tokens. It’s about more than just storage; it’s about having a dynamic control center for your assets.

Wow, managing tokens just got a whole lot trickier than I imagined.

Okay, so check this out — SPL tokens are the lifeblood of the Solana ecosystem. They’re native Solana Program Library tokens, which means they’re lightning-fast and super cheap to transfer. But with that speed comes complexity, especially when you’re tracking multiple tokens across various DeFi protocols. I remember once trying to manually track my yield farming rewards across three different projects—what a mess.

On one hand, the efficiency of Solana’s network makes yield farming incredibly attractive; low fees mean you can move in and out of positions quickly. Though actually, this constant movement makes portfolio tracking a real challenge. You can’t just glance at a balance sheet once a week and expect to know what’s going on.

My instinct said I needed tools that sync automatically with my wallet, so I wasn’t staring at spreadsheets forever. That’s when I realized having a wallet with built-in portfolio tracking features is a game changer. The solflare wallet includes this functionality, which saved me from a lot of guesswork and frustration.

Something felt off about the common advice to use multiple wallets to “diversify risk.” It actually made my tracking harder, not easier. I had to jump between apps, each with different interfaces and quirks. So, consolidating to a wallet that supports all my tokens and staking activities in one place turned out to be very very important.

Hmm… yield farming itself is like a double-edged sword. The returns can be juicy, but the strategies often require active management. You gotta keep an eye on APYs, lock-up periods, and impermanent loss risks. And if your wallet doesn’t alert you or integrate with these protocols, you might miss out on rewards or, worse, lose funds.

At first, I thought a simple hardware wallet would be best—it’s the gold standard for security, right? But honestly, the convenience factor for DeFi staking on Solana is huge. You want a wallet extension that plugs into your browser, makes staking seamless, and keeps your keys safe. Plus, it should play nice with all those yield farming dashboards.

Check this out—wallets like solflare wallet have built-in support for staking and DeFi apps, which means you can stake your SPL tokens directly without hopping through hoops. That integration speeds up your workflow and lowers the chance for error.

Okay, here’s a small rant: what bugs me about some wallets is how they bury staking options deep in their menus or make it hard to see your rewards in real-time. It’s like they expect you to be a rocket scientist just to harvest yield. Solflare’s interface, on the other hand, feels intuitive and straightforward—no fluff, just what you need.

Plus, there’s another layer to think about—portfolio tracking isn’t just about numbers. It’s about understanding your exposure and risk. When you stake SPL tokens, your assets are locked up, which affects your liquidity. A good wallet helps you see this in context, so you don’t accidentally overcommit funds that you might need in a pinch.

Honestly, sometimes I get overwhelmed by all the DeFi terminology flying around. Yield farming, liquidity pools, staking, APR, APY… It’s a lot. But the right wallet acts like a guide, breaking down these complex concepts into manageable pieces. It’s like having a trusted buddy who whispers, “Hey, you might want to check your rewards here.”

Speaking of which, the visual layout of your wallet dashboard matters more than you think. When I first started, I used wallets that just listed tokens as a bland list. No context, no insights. Switching to a wallet that groups tokens, shows staking status, and even projects yield farming returns changed how I approached my portfolio completely.

Now, here’s the kicker — when you’re actively yield farming, your portfolio isn’t static. It’s constantly shifting with rewards compounding, new staking opportunities popping up, and price movements all affecting your net worth. Trying to keep all that in your head is impossible. You need a wallet that refreshes data often and supports real-time tracking.

It’s funny, though. Even with all the tech, sometimes I still miss a reward window or forget to unstake on time. Human error is real. That’s why I appreciate wallets that send notifications or integrate with third-party apps that keep me in the loop.

Okay, so I’m biased, but I really think the Solana ecosystem is maturing fast, and wallets like solflare wallet are leading the way in making DeFi accessible without sacrificing security. If you’re serious about SPL tokens and yield farming, jump on a wallet that supports these features natively.

Oh, and by the way, if you’re still hesitant about browser extensions because of security worries, it’s understandable. But these wallets have come a long way with encryption and user controls. Just remember to keep your seed phrase offline and never share it. Simple stuff that’s very very important.

Before I forget, one more thing about portfolio tracking: it’s not just about numbers on a screen. It’s about making informed decisions, understanding when to exit a yield farm, or reallocating your SPL tokens to better opportunities. Your wallet should empower you to act, not just observe.

In the end, managing SPL tokens and yield farming rewards effectively boils down to picking tools that match your style and needs. If you’re hands-on and want granular control, go for a wallet that gives you deep insights and easy staking options. If you’re more casual, find one that simplifies things without hiding the essentials.

So, yeah, portfolio tracking and yield farming on Solana are a bit like a dance—you gotta know the steps and have the right partner. For me, that partner is the solflare wallet. It’s not perfect—nothing ever is—but it’s a solid companion in this fast-paced space.

I’m not 100% sure where all this will lead in the next few years, but one thing’s clear: as DeFi grows, wallets will need to keep evolving. Meanwhile, having a tool that keeps your SPL tokens safe and your yield farming strategy clear is the best bet. Until then, happy farming—and watch those tokens closely!